Lennox Computer LILAC Business Software

6/333 Queensport Rd North MURARRIE QLD 4172

Brisbane, Australia

http://www.lennox.com.au

Brisbane, Australia

http://www.lennox.com.au

ERP Business Accounting Software

Distribution, Manufacturing, Timber

Phone: 0418 886 912

Est. 1980

| Contact Us | Downloads | eCommerce | Demonstration Software |

LILAC Single Touch Payroll

LILAC Single Touch Payroll software forwards employee tax and super information to the ATO.

From 1 July 2018 a law change requires employers with 20 or more employees to use Single Touch Payroll.

Employers will be required to send payroll information to the ATO as part of each payroll process.

1 July 2019 Single Touch Payroll starts for employers with 19 or less employees.

From 1 July 2018 a law change requires employers with 20 or more employees to use Single Touch Payroll.

Employers will be required to send payroll information to the ATO as part of each payroll process.

1 July 2019 Single Touch Payroll starts for employers with 19 or less employees.

LILAC integration of Single Touch Payroll is an effective implementation of the requirements of the Australian payroll regimen, capturing data for both payroll and costing outcomes.

LILAC Payroll implements Single Touch Payroll reporting requirements allowing users to correctly forward payroll information to the ATO.

LILAC Payroll is immediately available as a stand alone business payroll system, or is included as part of LILAC ERP Business Accounting Software.

LILAC Payroll implements Single Touch Payroll reporting requirements allowing users to correctly forward payroll information to the ATO.

LILAC Payroll is immediately available as a stand alone business payroll system, or is included as part of LILAC ERP Business Accounting Software.

Information regarding Single Touch Payroll can be found at:

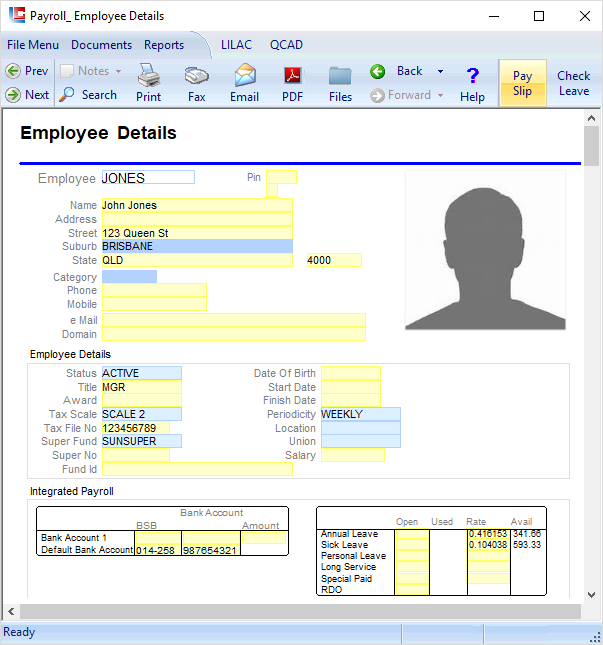

LILAC Employee Ledger Accounts

A fully detailed transaction history of debits and credits is maintained for each and every employee where a credit represents an increase in entitlement or gross pay, and a debit represents a net payment or deduction. Every employee ledger account is cleared to zero each pay period as a natural audit of the cyclical operation of the payroll ledger.

This history is maintained for an indefinite time. In practice most users maintain one to five years of full detail in the LILAC Payroll Ledger to ensure financial detail is available for reporting and analysis purposes.

This history is maintained for an indefinite time. In practice most users maintain one to five years of full detail in the LILAC Payroll Ledger to ensure financial detail is available for reporting and analysis purposes.

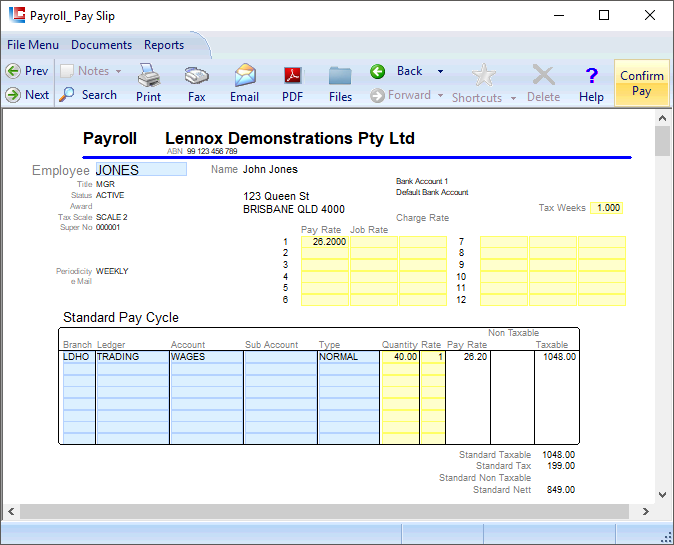

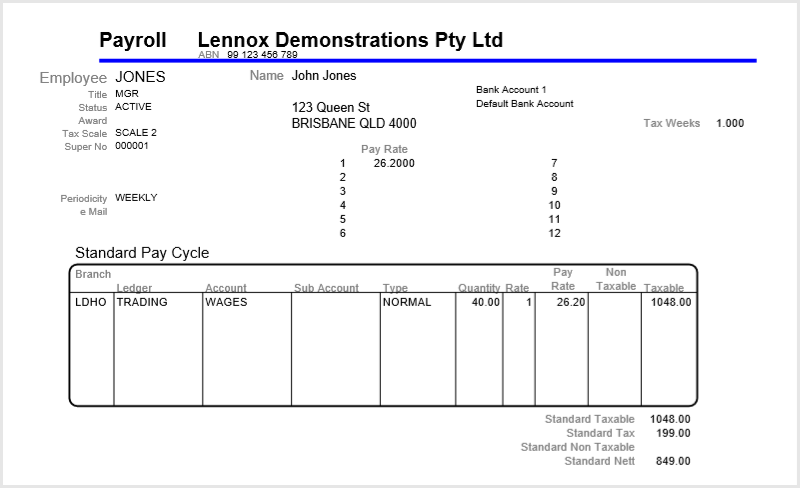

WYSIWYG Pay Slip

A LILAC WYSIWYG (What You See Is What You Get) Pay Slip plays the dual role of employee data entry and periodical pay slip. This ensures routine cross-checking and validation of employee data as part of the repetitive pay cycle. A report form of pay slip is also available as an alternative where a more restricted approach to employee management is appropriate.

* A WYSIWYG Pay Slip can be emailed, printed, or converted to PDF as it appears on the monitor.

APCA Electronic Funds Transfer

In common with the LILAC Creditors module, the LILAC Payroll module provides a straight forward interface to the Australian Banking EFT format enabling the routine processing of employee payments.

Job Costing and Integration

The LILAC Payroll module operates within the context of the LILAC double-entry accounting data-base such that a very natural interface occurs to job costing, work in progress and labour invoicing activity.

The power and efficiency of the LILAC database engine enables any size payroll up to 60,000 employees to be managed in minimal time and effort.

LILAC Payroll has been effectively deployed in large scale agency employment labour billing applications and offers fully integrated client invoicing functions, where all data upon which invoices are created, is captured from payroll processing with no additional effort.

The power and efficiency of the LILAC database engine enables any size payroll up to 60,000 employees to be managed in minimal time and effort.

LILAC Payroll has been effectively deployed in large scale agency employment labour billing applications and offers fully integrated client invoicing functions, where all data upon which invoices are created, is captured from payroll processing with no additional effort.

Lennox Computer - 07 3267 7880

Brisbane, QLD, Australia.

Brisbane, QLD, Australia.